Export and customs information.

Trouble-free customs clearance.

Export and customs information.

Trouble-free customs clearance.

Customs clearance is mandatory when goods are exported to countries which are not part of the European Union. We have compiled all the information you need about exports and customs, such as details of commercial and pro forma invoices.

The commercial invoice. For all EU exports.

The commercial invoice. For all EU exports.

According to current customs regulations, all shipments of goods or documents to non-EU countries must be declared. This means that the shipment must be accompanied by a commercial invoice or pro forma invoice. The commercial invoice is issued if the goods are of commercial value. A pro forma invoice is issued if the goods have no commercial value.

The document provides information about the consignor and the consignee and above all contains a complete description of the contents of the shipment, together with details of their value. The declaration must be signed by the consignor. One original and three copies must accompany the shipment.

Here you will find an online form with which you can create your commercial invoice or pro forma invoice and then print it out on your company stationery.

The export declaration. Required for goods worth over 1,000 €.

The export declaration. Required for goods worth over 1,000 €.

The export declaration is required for countries outside of the EU for all shipments of goods which have a value of over 1,000.- €. If the value is higher than 3,000.- € the shipment has to be cleared in advance by the responsible customs office.

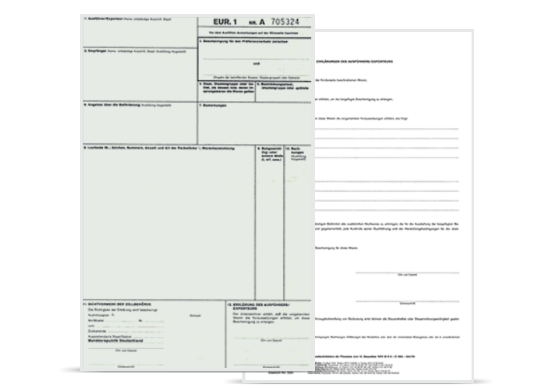

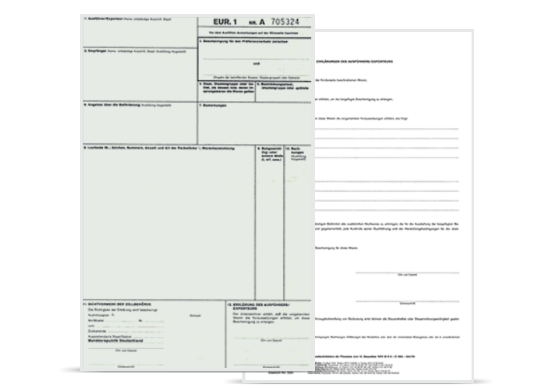

For the export declaration there is a standardised form which is available, for example, from the chamber of commerce. The form consists of three pages which have to be submitted complete to the customs office of export. After clearance Page 1 is retained there for purposes of recording the data, Page 2 goes to the national department of statistics and Page 3 is released to the consignor.

For a number of entries it is necessary to provide key numbers or other codes. If you do not know these key numbers you can download lists here which will provide you with the necessary information.

For information on how to make all the entries correctly please see our online guide.

The movement certificate. For goods from Europe.

The movement certificate. For goods from Europe.

The EUR 1 movement certificate is a preference document for goods which are produced in the EU. This entitlement to preference can be important for the calculation of the import duties which the consignee of the goods has to pay. The certificates are created by the consignor on the relevant standard form and submitted to the customs department for export purposes. The forms are available from the chamber of commerce.

The EUR 1 certificate is valid for the shipment of goods within the European Economic Area (EEA) and to the following countries: Egypt, Algeria, Bulgaria, Israel, Jordan, Ex- Yugoslavia (Bosnia-Herzegovina, Serbia, Montenegro, Kosovo, Croatia, Macedonia), Lebanon, Morocco, Palestine, Syria, Tunisia, Norway, Iceland, Liechtenstein, Switzerland, South Africa, Chile, Mexico, Albania, Andorra, states of the African, Caribbean and Pacific area and overseas territories.

Our online guide will show you how to make all the required entries correctly.

Prohibited Goods

Prohibited Goods

For our own protection and the protection of our customers, there are some goods we cannot store or send. First and foremost these are objects that are classed as hazardous under national and international laws. Also excluded from transport are any items that might represent a danger to people or other goods being transported, on account of their characteristics or their packaging. Also excluded from transport are:

Excluded from provision of shipping are Consignments:

-

not protected or packed in a manner corresponding to their weight, shape, contents feature (especially fragility) or with missing required data about the Consignor or the Consignee,

-

apparently damaged

-

weapons, ammunition, explosives, pyrotechnic articles for which their transport, shipping and delivery are prohibited in accordance with respective generally binding legal regulations of the Slovak Republic without presence of a person possessing appropriate authorisations pursuant to the said regulations; narcotic and psychotropic substances, flammable substances, any other things, objects, substances or materials for which their transport, shipping and delivery are prohibited pursuant to respective generally binding regulations of the Slovak Republic or the listed operations are prohibited in the way in which DPD carries it out with other consignments

-

containing goods in value exceeding 10.000

-

with weight more than 50kg for domestic shipping service and more than 31.5kg for international shipping service; with length exceeding 1.75m and circumferential length exceeding 3m, circumferential length = length of the longest side + double sum of two shorter sides,

-

containing dyes, adhesives and other liquid substances which may be damaged during the shipping, or they can damage or depreciate other Consignments, or Forwarder's equipment,

-

living animals or human and animal remains, medical waste, biological material (waste) and similar items,

-

C.O.D., besides the countries listed in par. 5.2, and customs entry, for shipping abroad,

-

C.O.D for which the value of amount to be collected exceeds the amount of 6,640 in domestic shipping, 70,000,- CZK to the Czech Republic, 500,000,- HUF to Hungary and 10,000,- PLN to Poland,

-

containing perishable goods, damageable goods as well as goods which must be protected in a special manner or which must be handled in a special manner also on condition that instructions for special Consignment handling are followed (glass bottles or similar fragile containers), damageable goods, goods susceptible to temperature changes, perishable goods,

-

whose shipping and possession is illegal or prohibited with respect to safety, public order and rights of third parties, or Consignments missing delivery address or P.O. Box ship-to-address.

Homepage / Support / International / Export and customs information