International shipping made easy. With DPD.

International shipping made easy. With DPD.

Customs clearance is mandatory when goods are exported to countries which are not part of the European Union. We have compiled all the information you need about exports and customs, such as details of commercial and pro forma invoices.

Required documents

Below you can find out which papers you will need for international shipping with DPD, and also how to fill in the documents correctly. There is also an online form for producing your commercial invoice. Simply complete the form and print it out on your own company letter-paper. In addition we support you with our shipping planner and delivery time calculator in preparing and coordinating your international parcel shipments.

Take the easy option – ship your parcels worldwide with DPD.

Required documents

Below you can find out which papers you will need for international shipping with DPD, and also how to fill in the documents correctly. There is also an online form for producing your commercial invoice. Simply complete the form and print it out on your own company letter-paper. In addition we support you with our shipping planner and delivery time calculator in preparing and coordinating your international parcel shipments.

Take the easy option – ship your parcels worldwide with DPD.

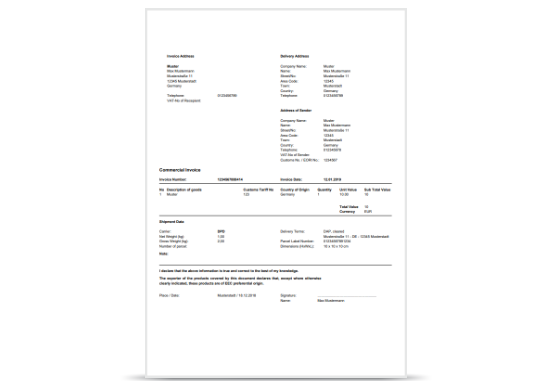

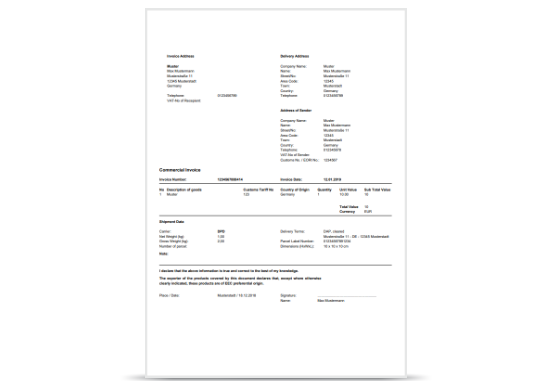

This is why you need a commercial invoice

This is why you need a commercial invoice

In accordance with the applicable customs regulations, the shipment of goods or documents outside of the EU is subject to declaration. This means that the goods have to be accompanied by a commercial invoice or a pro forma invoice.

- A commercial invoice is drawn up if the goods have commercial value.

- A pro forma invoice is drawn up if the goods have no commercial value.

Whether it's a commercial invoice or a pro forma invoice, the document indicates the consignor and consignee, contains a full description of the contents of the shipment and details of their value. It is then signed by the consignor, who sends the original and three copies with the parcel.

This enables you to create your commercial invoice or pro forma invoice and print it out on your company stationery.

- COMING SOON -

Export declaration

Export declaration

An export declaration is necessary for shipment outside the EU with a value of more than € 1.000. A verbal declaration can be made for goods whose value is less than € 1.000.

PLDA stands for Paperless Customs & Excise and is is the application for the electronic submission and processing of declarations. PLDA offers two options for submitting declarations:

-

PLDA-Web: a web application, which is made available for FREE by the government authority for submitting customs and excise declarations.

-

PLDA-EDI: an application which makes it possible to submit customs and excise declarations electronically with an EDI message (EDIFACT or XML) which is sent by your computer system to the customs and excise computer system.

In view of the complexity of completing an export declaration it is advisable to have your document drawn up via a customs agent. You can contact your local customs office for more information about this.

For a number of entries it is necessary to provide key numbers or other codes. If you do not know these key numbers you can download lists here which will provide you with the necessary information.

All the necessary information about the movement certificate.

All the necessary information about the movement certificate.

The EUR 1 certificate is a preferential document for goods that are produced inside the EU and which fulfil conditions in the various origin protocols concluded with destination countries. This preference can be important for the addressee of the goods in the country of destination for the calculation of import duty.

Use the EUR 1 document for these destinations

The EUR 1 certificate is used for the export of goods outside the European Union to the European Economic Area (EEA), Egypt, Algeria, Israel, Jordan, the former Yugoslavia (Bosnia-Herzegovina, Serbia, Montenegro, Kosovo, Croatia, Macedonia), Lebanon, Morocco, Palestine, Syria, Tunisia, Norway, Iceland, Liechtenstein, Switzerland, South Africa, Chile, Mexico, Albania, Andorra, the ACP group of states (states in Africa, the Caribbean region and the Pacific Ocean) and overseas countries and territories.

How to create a EUR 1 document

This certificate is drawn up by the sender/exporter while using the standard form available for this and then handed over to customs. These forms can be obtained from customs offices.

Not mandatory for goods with a value less than 6,000 €

An EUR1 document is not mandatory for the export of goods when the value is less than €6,000 because a declaration of origin on the invoice is then sufficient: “The signatory declares that the goods stated in this document that were obtained in the EU satisfy the rules relating to origin which apply in preferential trade with …. (destination country). Signature”

Commercial invoice

Shipping planner: our information on international shipping

Efficient worldwide shipping – we’re experts in the field. By selecting your country of destination in our shipping planner, you will receive all important information about delivery times and country-specific import restrictions.

From

To

To

Need further assistance? Contact us.

* Non-binding indicative lead time subject to variation - e.g. Time for customs clearance is not taken into account in the lead time calculation.

Detailed shipping information per country

Help with the preparation and coordination of your international parcel shipments.

Fuel surcharge

The fuel surcharge for ground transport is valid for the following DPD products: DPD BUSINESS, DPD GUARANTEE, DPD 18:00, DPD 12:00, DPD 10:00

Valid for DPD parcels from | Diesel surcharge in % | Kerosene surcharge in % |

| 12.2022 | 16.00% | 34.25% |

| 11.2022 | 17.50% | 39.25% |

| 10.2022 | 16.00% | 35.25% |

| 09.2022 | 15.00% | 35.75% |

| 08.2022 | 15.50% | 37.25% |

07.2022 | 17.00% | 42.25% |

| 06.2022 | 15% | 40.75% |

| 05.2022 | 14.50% | 40.75% |

04.2022 | 12.00% | 28.75% |

03.2022 | 10.25% | 25.40% |

02.2022 | 10.00% | 23.65% |

| 01.2021 | 9.25% | 24.00% |

Diesel surcharge in % |

|---|

| 12.2022 | 16.00% |

|---|

| 11.2022 | 17.50% |

|---|

| 10.2022 | 16.00% |

|---|

| 09.2022 | 15.00% |

|---|

| 08.2022 | 15.50% |

|---|

07.2022 | 17.00% |

|---|

| 06.2022 | 15% |

|---|

| 05.2022 | 14.50% |

|---|

04.2022 | 12.00% |

|---|

03.2022 | 10.25% |

|---|

02.2022 | 10.00% |

|---|

| 01.2021 | 9.25% |

|---|

Kerosene surcharge in % |

|---|

| 12.2022 | 34.25% |

|---|

| 11.2022 | 39.25% |

|---|

| 10.2022 | 35.25% |

|---|

| 09.2022 | 35.75% |

|---|

| 08.2022 | 37.25% |

|---|

07.2022 | 42.25% |

|---|

| 06.2022 | 40.75% |

|---|

| 05.2022 | 40.75% |

|---|

04.2022 | 28.75% |

|---|

03.2022 | 25.40% |

|---|

02.2022 | 23.65% |

|---|

| 01.2021 | 24.00% |

|---|

Exlcuded postal codes

DPD 10:00, DPD 12:00 and DPD 18:00 are available for limited area codes. Download here the excluded postcodes.

Home / Shipping guide / International