The European Union is amending the current rules of the European VAT system as of 1 July 2021 as part of the so-called "digital package". The new rules are intended to make the digital internal market fairer, simpler and more fraud-proof.

What will change?

From 1 July 2021 the previous exemption limit of 22 euros will be dropped. This means that as a rule you will have to pay import charges (import VAT and customs duty) for any goods you order from a non-EU country (e.g. China, UK, USA), in the country where the consumption of the ordered goods takes place. From this point on a customs declaration must always be submitted for all shipments from a third country. We take care of this for you together with our partner Sovereign. You simply pay the import duties via our secure online payment platform.

Charges for goods worth less than one euro are not levied. These tax-exempt consignments can continue to be delivered without charges unless there are prohibitions or restrictions.

You can find more information about the charges to be paid on the information website of the German customs authorities.

Why does the exemption amount cease to apply?

The removal of the exemption limit is intended to ensure that goods imported from non-EU countries are not subject to preferential VAT treatment compared to goods purchased within the EU.

What does this mean for me as a consignee?

From 1 July 2021 you as a consignee will have to pay taxes on goods from a non-EU country if they exceed a value of 1 euro. You can pay the taxes conveniently via our secure payment platform, unless they have already been paid by the shipper of the goods. This is the case, for example, if you are buying goods worth €150 or less outside the EU and the seller is registered in the new VAT system and uses the one-stop shop for import (IOSS.Import-One-stop-shop). If the sender is not IOSS-registered, you as the consignee will have to pay the import VAT and possible customs duties, which we will have to bill you for.

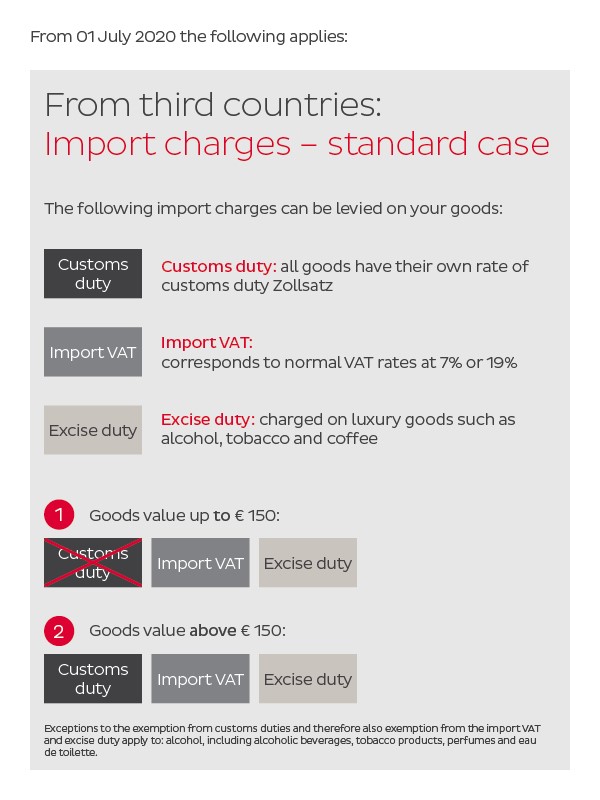

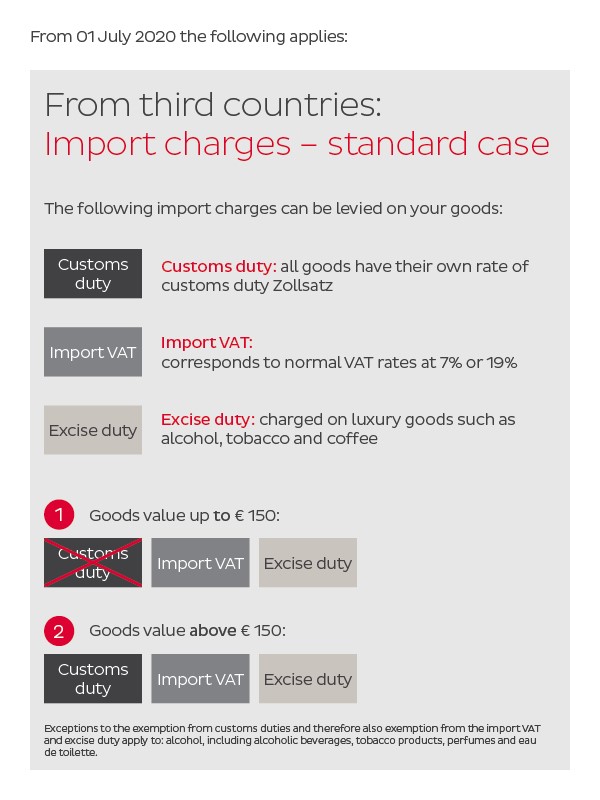

How are import taxes calculated?

The goods value of the consignment is decisive for the calculation of the import VAT. The decisive factor is therefore the amount actually paid to receive the goods. If the value of the goods is up to 150 euros, the import continues to be duty-free. This value limit will remain in place after 1 July 2021. Only the import VAT of 19 per cent or 7 per cent (e.g. for books) and possibly excise duties, for example on alcohol and alcoholic products, perfume and tobacco products must be paid.

Example:

You order cable ties worth € 10 in China. The import VAT for cable ties is 19 per cent. Shipments up to a value of 150 euros are duty-free, and excise duties do not apply either. We charge a administration fee for customs clearance, which will be invoiced upon delivery by us.

Invoice amount: € 10

Calculation of import sales tax: 19 percent of € 10 = € 1.90

Import VAT and administration fee (= fees to be paid to DPD): € 1.90 import VAT + administration fee for customs clearance

What should shippers from non-EU countries who wish to import goods into Germany bear in mind?

So that we can transport your shipment to the consignee as quickly as possible and avoid delays in customs clearance, we need:

-

A complete and accurate description of the goods

-

Electronic transmission of the commercial invoice with the following data:

-

Address and contact details of the shipper, consignee and responsible importer (IoR = importer of record).

-

Value of the goods, freight and insurance costs (depending on the chosen Incoterm)

-

Identification of individual items, detailed description of the goods, HS (harmonized system for goods classification) codes and country of origin

-

Incoterm, weight and quantity

-

Reason for export

-